b&o tax credit

The tax amount is based on the value of the manufactured products or by-products. Foreclosure and Eviction Prevention service inquiries can be sent to.

Thousands Of Washington Businesses Could Get A Tax Break King5 Com

For homeowners outside of New York City.

. It receives a credit for 8976 which is equal to the amount it owes to Bellevue for Manufacturing. The credit equals 20 percent of the wages and benefits a business pays to or on behalf of a qualified employee up to a maximum of 1500 for each qualified employee hired. ADHD Tax and Learning.

BO taxes do not allow for any deductions for business expenses with the exception of gross receipts a business earned in another state such as Oregon. What is the BO tax credit. BO Tax Credit Program Direct your tax dollars back into your community Main Street Tax Credits are a way of ensuring your tax dollars are invested in your downtown community.

Select your county below. BO Tax Credit Program Direct your tax dollars back into your community Main Street Tax Credits are a way of ensuring your tax dollars are invested in your downtown community. Last month was an expensive month to be me.

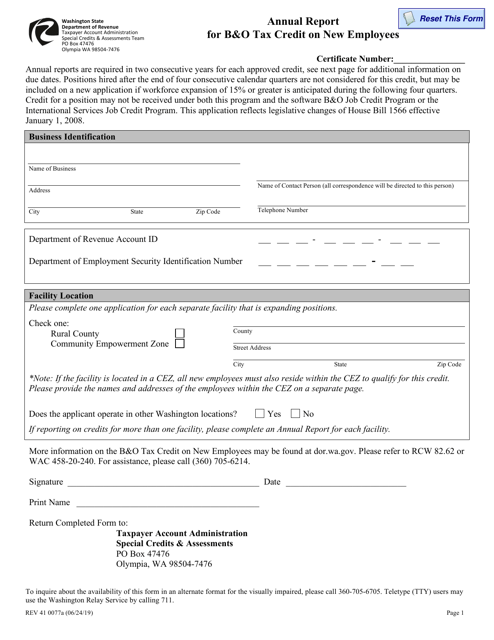

Rural County BO Credit for New Employees High Technology BO Tax Credit Small Business BO Tax Credit Multiple Activities Tax Credit MATC Credit. On the next page select your city or town. There are two credits available to help taxpayers save.

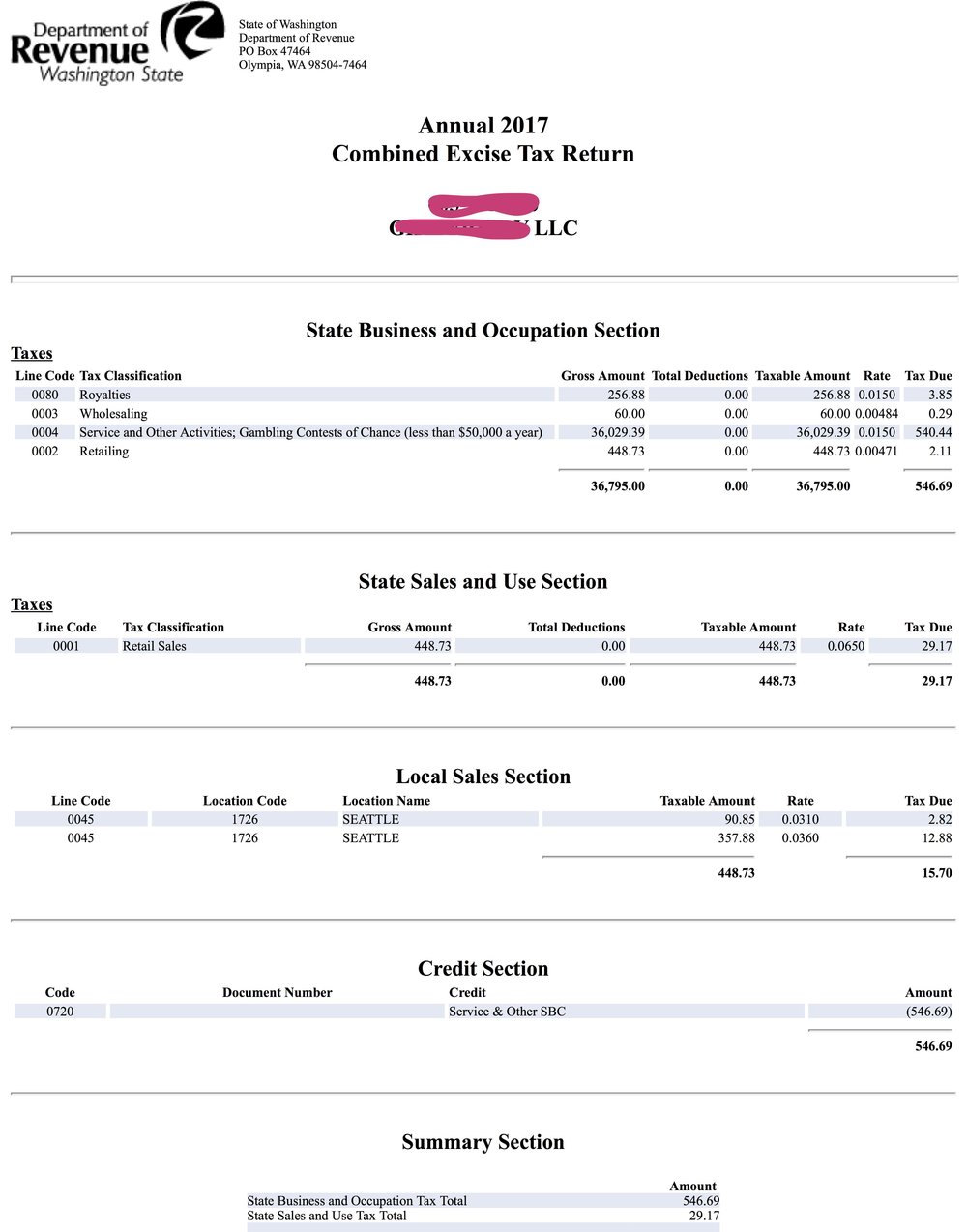

Company B then fills out the Seattle multiple activities tax credit MATC worksheet. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. If taxpayers their spouses or their dependents take post-high school coursework they may be eligible for a tax benefit.

The property tax is an ad valorem tax meaning that it is based on the value of real property. Home Ownership inquiries can be sent to. If any taxpayer fails to remit the BO return or fails to remit in whole or in part the proper amount of tax a penalty in the amount of five percent 5 of the tax for the first month or fraction.

The major BO tax credits are. To find the amount of your HTRC check. I had opened an Amazon credit card to get some bonus but forgot to link it into my budgeting app and by the.

Depending on your situation filing your Seattle taxes may be relatively simple or fairly complex. Property taxes are based on the value of real property. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax.

Washington Main Street B O Tax Incentive Program Bainbridge Island Downtown Association

Main Street Tax Incentive Program Downtown Bellingham

Dayton Development Task Force Dayton Wa Chamber Of Commerce

Business Occupation Tax Bainbridge Island Wa Official Website

Why Our B O Tax Is Unfair R Seattlewa

Taxes Incentives Doing Business In Stanwood Wa

Gig Harbor Downtown Waterfront Alliance Your B O Taxes Can Stay Right Here In Gig Harbor Through The Washington Main Street B O Tax Credit Program Good For Your Business Good For The

Parkersburg City Council Continues B O Tax Exemption For Local Businesses Wv News Wvnews Com

Washington Main Street B O Tax Incentive Program Bainbridge Island Downtown Association

The Basics Stevensonmainstreet

Form Rev41 0077a Download Fillable Pdf Or Fill Online Annual Report For B O Tax Credit On New Employees Washington Templateroller

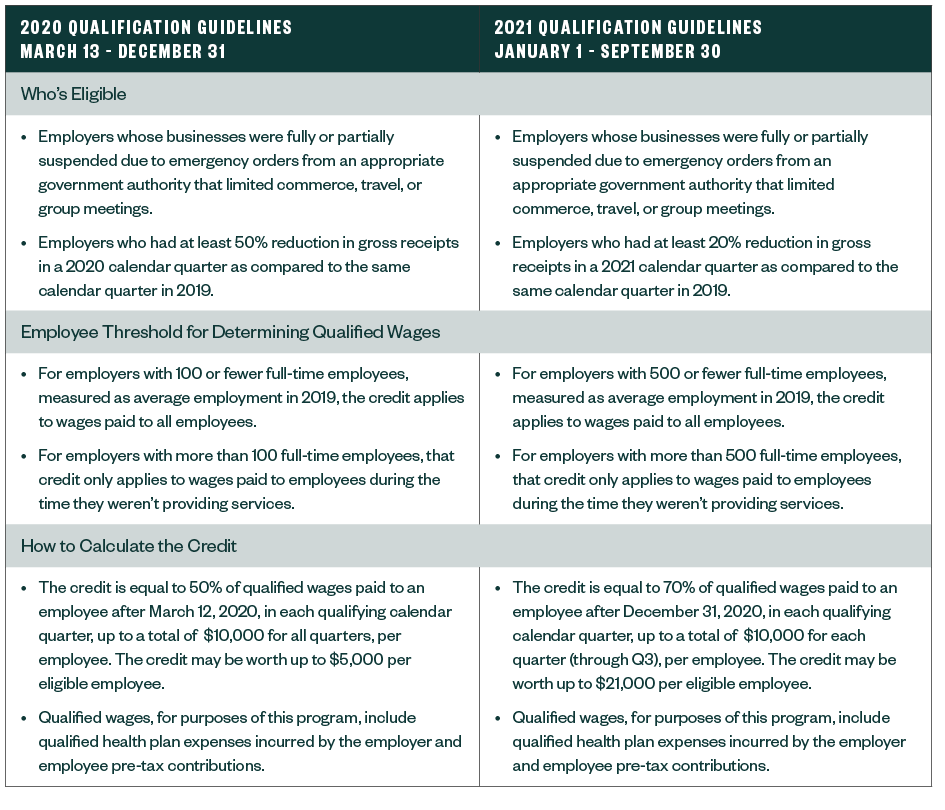

Washington State B O Tax Guidelines For Covid Relief

B O Tax Credit Program Sumner Main Street Association

Main Street Tax Credit Ellensburg Downtown Assoc

Business Occupation Tax Clarksburg Wv

Tax Exempts And Washington S Business And Occupation Tax

City Of Tacoma Tax License Pages 1 4 Flip Pdf Download Fliphtml5

Wheeling Finance Committee Approves B O Tax Credit Lede News

Washington State Simplifies Its Sales And B O Tax Nexus Rules 2019 Articles Resources Cla Cliftonlarsonallen